Running a business means collecting money from your customers. The time-honored way of collecting payment is through invoicing customers with a detailed list of the products or services you provided. It’s a necessary part of your bookkeeping if you’re going to keep money flowing in. But if bookkeeping isn’t your strong point or you don’t have much time to balance your paperwork duties with your operational duties, you’ll get behind on repayment. Here are some tips to help you manage invoices so you keep money flowing and spend less time chasing paperwork around.

Set Up Recurring Invoices

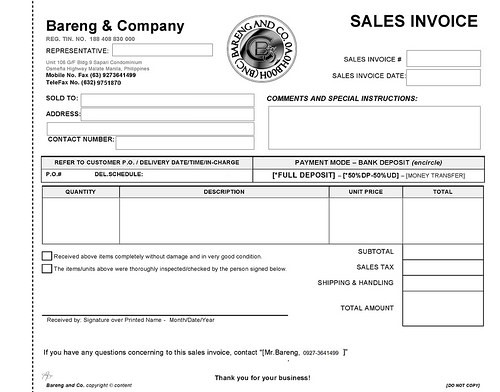

Image via Flickr by vclub2010

Have a customer that you do the same job for month in and month out? If there’s little to no variation in the work output, create an invoice that can be sent with minor alterations every billing cycle. Just change the date so there’s no confusion as to which month you’re requesting payment for. Also leave enough room on the invoice in case you need to add more information in the event that there’s more work done that month.

Recurring invoices can get sent automatically on the date that you set. Your customer can predict when they’ll get the invoice and prepare for payment. In turn, you get a regular cash flow without having to put much effort forth.

Use Online Management Tools

Software suites that generate invoices are sometimes limited in their scope. They may not be able to automatically attach an invoice to an email or auto-generate a recurring invoice so that you don’t have to. And if they do, they charge for the functionality. Online tools like Kabbage streamline the process for you and even add in a payment option for your client in the form of a short-term loan. The advantage to you is the ease of data entry and submission of the invoice to your customer without having to pay through the nose for the features. And if your customer decides to take advantage of the short-term loan, you get paid faster.

Pay Attention to the Details

Make sure you know where you’re sending the invoice, who’s supposed to receive it, and that your customer understands the terms of repayment. For you that requires paying attention to the email address and confirming that the right person is at the other end of that email address. If you’re not sure or if you’ve heard rumors of a change, pick up the phone and call for clarification. Small mistakes often turn into big ones, so make it a point to avoid them altogether.

Another problem that can happen is a misunderstanding of terms. Discuss your repayment terms with your customer up front and make sure they’re understood. Don’t assume that the customer is going to read your mind and understand your terms.

These tips are designed to help you get paid and avoid getting into trouble with your cash flow. When in doubt, ask your customer what they prefer for invoicing and turn that preference into your routine for regular payment.